Federal tax employer withholding calculator

Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and various tax filing options. 2022 Federal Tax Withholding Calculator.

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

Online tax withholding calculator 2021 is based on an excel spreadsheet named Income Tax Withholding Assistant to help small employers compute the amount of federal income tax to withhold from their employees wages.

. All Services Backed by Tax Guarantee. Thats where our paycheck calculator comes in. Submit or give Form W-4 to your employer.

The IRS income tax withholding tables and tax. Use their most recent pay stubs and federal income tax return to help estimate income and other items for 2018. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

To calculate withholding tax youll need the following information. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. This is a projection based on information you provide.

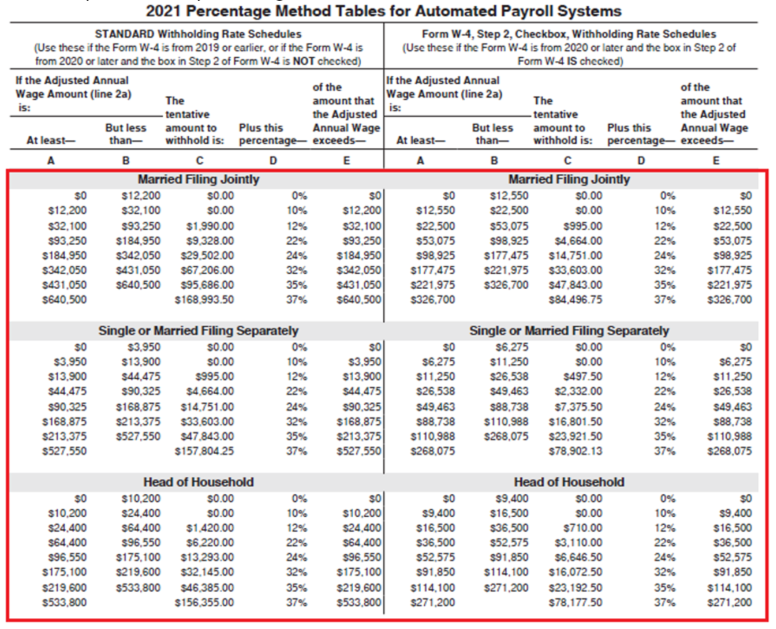

The wage bracket method and the percentage method. There are two main methods small businesses can use to calculate federal withholding tax. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Complete a new Form W-4P Withholding Certificate for Pension or Annuity Payments and submit it to your payer. The Federal Withholding Calculator can show you your potential federal tax withholding amount based just on just the gross amount of your PSERS monthly benefit payment or you can include other taxable funds. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer.

To determine what amount would be withheld on your PSERS monthly benefit payment you would enter the gross amount of your monthly benefit. Keep in mind the new tax law made significant changes to itemized deductions. Change Your Withholding.

Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. Each employees gross pay for the pay period. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator.

Under FICA you also need to withhold 145 of each employees taxable. You dont need to do anything at this time. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

The maximum an employee will pay in 2022 is 911400. The calculator helps you determine the recommended withholding allowance and additional withholding if any you should report on your W-4 form. The amount you earn.

IRS tax forms. 51 Agricultural Employers Tax Guide. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

To change your tax withholding amount. IRS Form W-4 is completed and submitted to your employer so they know how much tax to withhold from your pay. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

The amount of income tax your employer withholds from your regular pay depends on two things. It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming. Ask your employer if they use an automated system to submit Form W-4.

This Federal Income Tax Withholding Calculator is intended to be used as a tool to estimate your own monthly federal income tax withholding. This excel spreadsheet is published on IRS websiteFurther the spreadsheet is designed to help employers for the transition to the new. Social Security and Medicare.

Overview of Federal Taxes. This publication supplements Pub. Calculate your annual tax by the IRS provided tables.

Your employees W-4 forms. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest. 15 Employers Tax Guide and Pub.

The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Occupational Disability and Occupational Death Benefits are non-taxable. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Once you have determined the number of exemptions you should claim. However you can also claim a tax credit of up to 54 a max of 378. Your W-4 can either increase or decrease your take home pay.

For help with your withholding you may use the Tax Withholding Estimator. Fill in all information that applies to their situations. To keep your same tax withholding amount.

For employees withholding is the amount of federal income tax withheld from your paycheck. The information you give your employer on Form W4. As the employer you must also match your employees contributions.

If you want a bigger refund or smaller balance due at tax time youll have more money withheld and see less take home pay in your paycheck. Here are some tips for using the Withholding Calculator. To change your tax withholding use the results from the Withholding Estimator to determine if you should.

2020 Federal income tax withholding calculation. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. If you are married but would like to withhold at the.

How To Calculate Payroll Taxes Methods Examples More

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Federal Updates

Calculating Federal Income Tax Withholding Youtube

Paycheck Calculator Take Home Pay Calculator

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

Irs Calculator For Withhoulding For Taxes So You Don T End Up Owing A Ton After You Change How You File When Married Federal Income Tax Irs Irs Taxes

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

Pin On Tax

California Tax Calculator State Basic Facts Tax Relief Center Basic Facts Tax California

Federal Income Tax Fit Payroll Tax Calculation Youtube